Determining When to File a SAR

On-Demand Webinar:

StreamedAug 5, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

To SAR or not to SAR? That is indeed the question.

Using decades of experience and

real-world scenarios, David Reed will illustrate effective methods to

accurately sort out when to file a SAR – even with those close calls. Join this

high-energy program to ensure you are fully compliant with the growing

BSA/AML/CFT responsibilities.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Explain the underlying logic of the BSA/AML/CFT requirements

- Identify enumerated SAR triggers

- Fine tune your technique to handle borderline cases

- Create an effective internal escalation process

- Train staff on their roles in the AML/CFT process

- Use detailed regulatory guidance

- Appreciate SAR confidentiality and associated risks

- Understand current regulatory expectations and enforcement trends

WEBINAR DETAILS

Every financial institution needs to establish a

system to identify suspicious behavior, investigate the underlying facts, and

initiate a Suspicious Activity Report in the appropriate circumstances. And

don’t forget to take time to fine tune your BSA/AML/CFT processes. If one step

fails, the entire process is compromised, and you are at risk of potential BSA

violations – which could include monetary penalties or even criminal charges.

What if you’ve looked at a suspicious set of facts

over and over again and cannot decide if it rises to the level of a SAR? Your financial

institution needs to have an effective process of identification, evaluation,

and reporting of suspicious activities. But once you get past the enumerated

events which require a filing, there are still vast possibilities. This session

will review the primary components of the SAR decision, while also uncovering

the hidden landmines using real-world experience, regulatory examinations, and

FinCEN enforcement actions.

WHO SHOULD ATTEND?

This session is designed

for executives, managers, BSA officers, internal auditors, IT managers, branch

staff, compliance officers, and anyone involved in the BSA and risk management

processes.

TAKE-AWAY TOOLKIT

- SAR filing decision tree

- Red flags reference guide

- SAR quality checklist

- SAR escalation protocol template

- Regulatory guidance

- Detailed AML/CFT examination resources

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

TESTIMONIALS

"The speaker was engaging and interesting. He was extremely knowledgeable."

- Dawn, Illiana Financial Credit Union

"The content was great, especially the discussion of the trigger categories and corresponding behaviors and the escalation process. The handouts provided will be very helpful."

"The content was great, especially the discussion of the trigger categories and corresponding behaviors and the escalation process. The handouts provided will be very helpful."

- Catherine, Community Trust Credit Union

Presented By

Reed & Jolly, PLLC

Other Webinars That Might Interest You

Elder Exploitation: Warning Signs & Safe Harbor

by Molly Stull

SARs: Line-by-Line & Writing a Good Narrative

by Deborah L. Crawford

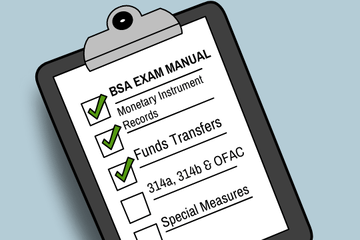

BSA Exam Manual Series: SARs & CTRs: Program Management & Exemptions

by Deborah L. Crawford

Compliance with E-SIGN, E-Statements & E-Disclosures

by Nancy Flynn

SAR Fraud Narrative Templates & New FAQs: Check Fraud, Elder Fraud, Cyber Crimes & More

by Deborah L. Crawford

Accurately Completing the CTR Line-By-Line

by Dawn Kincaid

New Compliance Officer Boot Camp

by Molly Stull

Deposit Operations Update

by Deborah L. Crawford

BSA Exam Manual Series: Monetary Instrument Records, Funds Transfers, 314a, 314b & OFAC & Special Measures

by Deborah L. Crawford

ACH Risk Management: Building a Robust Defense

by Randy Traynham

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC