TRID: Auditing the LE & CD for Compliance

On-Demand Webinar:

StreamedMar 6, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

This detailed session will dive into what auditors must know for TRID compliance.

Many tools will be provided to

aid in completing a TRID audit, including tips on calculating TRID-sensitive

dates, examples to ensure proper selection of the loan’s purpose, formulas to

verify calculations, and a list of common costs and their appropriate placement

within the Loan Costs table. Join us to learn more about this challenging topic.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Audit for timing requirements

- Determine if disclosures were issued in good faith

- Identify if a valid changed circumstance occurred

- Verify critical numbers using the FFIEC tool

- Review completed TRID documents for accuracy

WEBINAR DETAILS

TRID continues to be a challenging regulation, and it is critical that your

institution has implemented tools to regularly audit the Loan Estimate (LE) and

Closing Disclosure (CD) for accuracy. Join us as we review critical TRID

components, including document delivery timing requirements, determining if the

good faith standard was achieved, and identifying if a valid changed

circumstance was encountered and supported by file documentation. This program

will include an explanation of how to utilize the FFIEC’s disclosure

computational tool to test the accuracy of the annual percentage rate and

finance charges. In addition, it will provide guides to assist auditors with LE

and CD regulatory citations.

WHO SHOULD ATTEND?

This informative session

is designed for those responsible for TRID compliance, including mortgage

lenders, real estate lenders, loan closers, loan processors, compliance staff,

risk professionals, and audit personnel.

TAKE-AWAY TOOLKIT

- TRID calculation formulas

- Examples of purpose types defined by Regulations C and Z

- Changed circumstances worksheet

- Tolerance chart identified by fee category

- Sample loan cost comparison worksheet

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

Brode Consulting Services, Inc.

Other Webinars That Might Interest You

Financial Literacy Part 2: How to Interpret Key Ratios, Risks & Reporting

by Bryan Mogensen

Conducting a Physical Security Review & Risk Assessment

by Barry Thompson

2026 Regulatory & Industry Updates for Credit Professionals

by Robert L. Viering

Creating a Unique Strategic Plan for Your Financial Institution

by Marcia Malzahn

AI Series: Advanced AI Risk Management: Validation, Governance & Emerging Risks

by Dushyant Sengar

Fraud, Forensics & Incident Response: Managing & Mitigating Data Breaches

by John Moeller

Managing the Repossession Process, Including Notice & Sale

by David A. Reed

TRID Basics for Lenders & Processors

by Dawn Kincaid

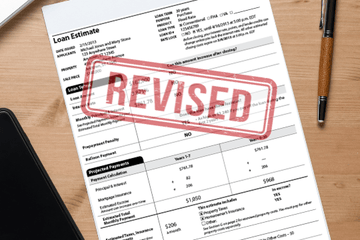

TRID: Changed Circumstances & Revised Loan Estimates

by Molly Stull

Safe Deposit Box Compliance: Disclosures, Due Diligence & Drilling

by Dawn Kincaid

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC