Financial Industry Essentials Module 6: Internal Controls: Overrides, Bank Bribery Act & Ethics

Policies and procedures may feel like red tape, but they’re vital safeguards for accountholders, your institution, and your team.

This module

will break down the fraud triangle and explain why overrides, transaction

limits, and internal controls are essential defenses — not hassles. It will

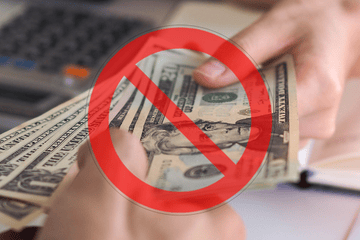

explain the Bank Bribery Act and highlight why employees, officers, and

directors must avoid accepting anything of value in connection with any

transaction/business. You’ll walk away informed, empowered, and ready to

protect what matters most.

NOTE: All materials are subject to copyright. Transmission, retransmission, or republishing of any webinar to other institutions or those not employed by your agency is prohibited. Print materials may be copied for eligible participants only.

Presented By

Brode Consulting Services, Inc.

Other Webinars That Might Interest You

Compliance with E-SIGN, E-Statements & E-Disclosures

by Nancy Flynn

Call Report Series: Call Report Fundamentals for New Preparers & Reviewers

by Stephen J.M. Schiltz

A to Z on Endorsements

by Deborah L. Crawford

Deciphering Tax Returns Part 1: Form 1040, Schedules B & C

by Timothy P. Harrington

BSA Exam Manual Series: CIP, CDD & High-Risk Customers

by Deborah L. Crawford

ECOA & Fair Lending, Including AI in Lending, Exam Hot Spots & More

by Shelli Clarkston

Financial Industry Essentials Module 8: Identity Theft, Red Flags & Fraud

by Molly Stull

ACH WSUDs vs. Stop Payments: Clarifying the Confusion

by Kari Kronberg

Collection Series: Advanced Collection Concepts

by David A. Reed

Consumer Real Estate Loans: Step-by-Step

by Dawn Kincaid

This Webinar Appears In

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC