ACH Reclamations & Garnishments

On-Demand Webinar:

StreamedSep 22, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Are ACH reclamations and garnishments sticky wickets?

Do you know what to do when an

accountholder dies? Should post-death payments be returned? If so, when? What

are the guidelines for handling garnishments? This webinar will unearth the

answers to these questions and more!

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Compare your institution’s liability regarding reclamations under the ACH rules and 31 CFR Part 210

- Understand the financial impact of signing a Master Agreement

- Explain the responsibilities associated with learning of an accountholder’s death

- Given a reclamation scenario, evaluate the type of payment received and appropriately apply the ACH rules or 31 CFR Part 210

- Determine the appropriate actions in a garnishment scenario under the Garnishment of Accounts Containing Federal Benefit Payments guidelines

This course is eligible for 1.8 AAP/APRP credits

WEBINAR DETAILS

What must be done when you learn of an

accountholder’s death? Are you responsible for acting upon a word-of-mouth

notification? Are you required to return post-death payments, or can you wait

for a reclamation? Join us to find the answers to these questions and compare

your financial institution’s liability related to post-death benefit payments

under the ACH rules and 31 CFR Part 210. You’ll learn your liability and how to

limit it according to what type of payment is received. The impact of signing a

Master Agreement and which payments are exempt from garnishment will also be

covered.

WHO SHOULD ATTEND?

This informative session

is ideal for ACH operations staff, compliance staff, auditors, and those

individuals with the AAP and APRP accreditation.

TAKE-AWAY TOOLKIT

- Resource guide for handling ACH reclamations and garnishments

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

TESTIMONIALS

"I thought the speaker was easy to understand. She explained everything thoroughly and answered all the questions very well."

- Kari, Solarity Credit Union

Presented By

EPCOR

Other Webinars That Might Interest You

Marijuana Update: On-Boarding, Payments, Monitoring & Schedule III Change Implications

by Deborah L. Crawford

1099 Reporting: Foreclosures, Repossessions & Debt Settlements

by Shelli Clarkston

Financial Industry Essentials Module 8: Identity Theft, Red Flags & Fraud

by Molly Stull

Enhancing Videoconference Compliance & Communication for Financial Institutions

by Nancy Flynn

Red Flags for Money Laundering

by Deborah L. Crawford

IRA Series: Beneficiary Payouts & Processes

by Loni Porta

ACH Boomerang: Exceptions from the ODFI Perspective

by Shelly Sipple

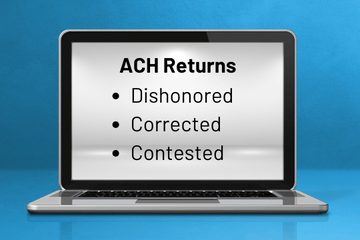

Dishonored, Corrected & Contested ACH Returns

by Kari Kronberg

CECL: What Auditors & Regulators Will Expect

by Stephen J.M. Schiltz

ACH WSUDs vs. Stop Payments: Clarifying the Confusion

by Kari Kronberg

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC