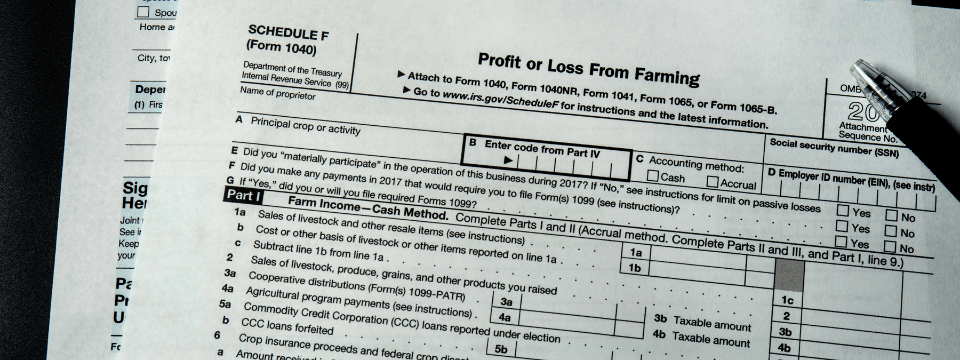

Deciphering Tax Returns Part 2: Form 1040, Schedules D, E & F

On-Demand Webinar:

StreamedFeb 24, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Part 2 of this two-part information-intensive series will continue the journey to convert Form 1040 personal tax returns into cash flow and will focus on Schedules D, E, and F.

Learn more about making solid

lending decisions by understanding how to get cash flow from personal tax

returns.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Identify the real cash flow from Schedule D: Capital Gains and Losses and determine whether it is recurring income or a one-time event

- See the real cash flow from a rental property or source of royalty income (Schedule E, Page 1) – it’s more than just adding back depreciation

- Weed out “phantom” pass-through incomes and find the real cash flow from partnerships and S corporations (Schedule E, Page 2)

- Determine if that farm is earning a cash profit or not (Schedule F)

WEBINAR DETAILS

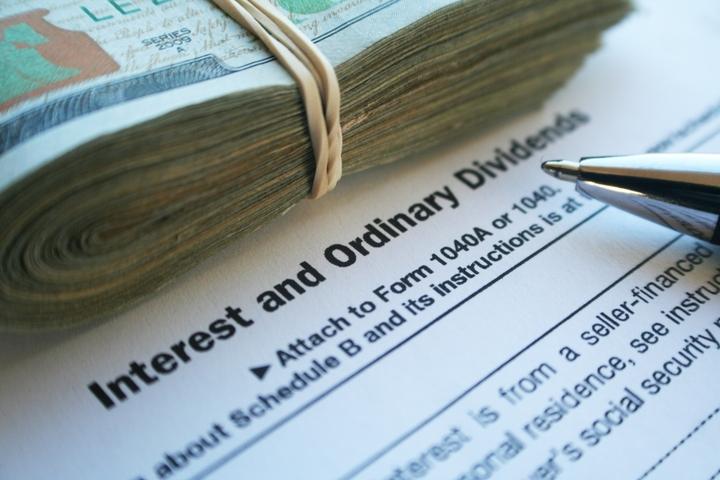

Tax returns don’t show cash flow; they show taxable

income. What you need to know is cash flow because that is how your loan is

paid back. With the process outlined in this session and the free Lenders Tax

Analyzer© software each registrant receives, you will gain an easy, reliable

method to convert a borrower’s personal tax return (Form 1040) into a

borrower’s cash flow statement.

In Part 2 of this two-part series, you will learn

to cash flow Schedule D: Capital Gains and Losses; Schedule E, Page 1 (Rental

and Royalty Income); Schedule E, Page 2 (Partnerships and S Corporations), and

Schedule F (Farm Income). When you finish these sessions, you will be able do a

little “magic” and convert taxable incomes into cash flows, which you can then

plug into your credit scoring model, debt-to-income ratio, or disposable income

calculation. (Note: This series is designed for consumer and commercial

lenders. This method does not follow Fannie, Freddie, or QM rules used in

mortgage lending.)

WHO SHOULD ATTEND?

This informative session

is designed for lending personnel, including chief lending officers, service

representatives, new accounts personnel, loan officers, loan underwriters,

credit analysts, loan processors, branch managers, CEOs, and other key lending staff.

TAKE-AWAY TOOLKIT

- Free copy of Lenders Tax Analyzer© software

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

TEAM Resources

Other Webinars That Might Interest You

Commercial Loan Documentation: Developing a Thorough Checklist

by Dawn Kincaid

Credit Analysis & Lending Series

Workplace Violence: Prevention Strategies & Survival Tactics

by Carol S. Dodgen

Today’s Board Essentials

Decrypting Personal Tax Returns Part 2: Form 1040, Schedules D, E & F

by Timothy P. Harrington

Credit Analysis & Lending Series: Cash Flow Analysis: Debt Service Coverage, Global Cash Flow & More

by Robert L. Viering

AI Series: Advanced AI Risk Management: Validation, Governance & Emerging Risks

by Dushyant Sengar

Deciphering Tax Returns Part 1: Form 1040, Schedules B & C

by Timothy P. Harrington

ENCORE SESSION: New IRS Auto Loan Rules Effective January 31, 2026: Vehicle Qualification & Interest Reporting Details

by David A. Reed

Enhancing Videoconference Compliance & Communication for Financial Institutions

by Nancy Flynn

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC