Legal Issues of Checks

On-Demand Webinar:

StreamedNov 13, 2024Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Is check fraud out of control?

Yes – and it brings us back to

the basic legal issues of checks. There are so many opportunities for poor

check handling processes to cause losses for your institution. Is your staff

well versed in processing checks – in all their iterations? Join this A-to-Z

schooling on the legal issues of checks to learn how to avoid losses and reduce

scams.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Understand endorsement rules

- Comprehend your legal responsibilities regarding stop payments and postdated and stale-dated checks

- Identify accountholder responsibilities on sight examination of checks

- Break down who will likely lose on fraudulent items, altered checks, and forgeries

- Use the 600+ page teller handbook that will be provided

- Define what is “knowledge” of death and explain what happens to checks at that point

WEBINAR DETAILS

This program will look at stop payments,

stale-dated, and post-dated checks. It will cover check issues, such as sight

examination, legal legends, forgeries, alterations, and forged endorsements.

You will also learn about check handling issues after death, such as who can

deposit what and what can be cleared after death. This primer is a must for all

branch staff and management.

WHO SHOULD ATTEND?

This informative session

is designed for tellers, new accounts personnel, branch deposit service staff, deposit

operations staff, deposit compliance professionals, management, trainers, and

anyone who manages checks.

TAKE-AWAY TOOLKIT

- Teller handbook

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

TESTIMONIALS

"Helpful and concise information that we can use for best practices at all branch locations."

- Siouxland Federal Credit Union

Presented By

Gettechnical Inc.

Other Webinars That Might Interest You

FDCPA: What's Expected as a Debt Collector?

by Molly Stull

Conducting a BSA Audit

by Deborah L. Crawford

HMDA Part 3: Commercial Loans

by Susan Costonis

Handling Difficult People: Warning Signs & Effective Tactics

by Barry Thompson, Arvin Clar

Harness the Power of AI in Your Marketing Strategy

by Eric C. Cook

Check Fraud & Scams

by Deborah L. Crawford

Check Breach of Warranty Blues

by Marcy Cauthon

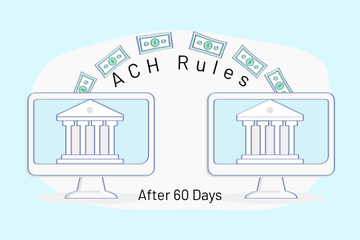

ACH Specialist Series: ACH Disputes: Reg E vs. ACH Rules After 60 Days

by Emily Nelson

Domestic Wires: Navigating the U.S. Payment System

by Jessica Lelii

Today’s Board Essentials Module 3: The Board’s Role with BSA/AML/OFAC

by Shelli Clarkston

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC